KPI (Key Performance Indicators)

A KPI is a measurement or a list of items that indicate the health of your finances and the health of your overall household estate. Completing the KPI list is designed to position your household to experience generational prosperity.

DTI (Debt-To-Income Ratio)

A DTI is one way lenders (including mortgage lenders) measure an individual’s ability to manage monthly payment and repay debts. DTI is calculated by dividing total recurring monthly debt by gross monthly income, and it is expressed as a percentage.

Financial Assessment (Take A Current Assessment)

A financial assessment is a tool for viewing the financial condition of an individual or a business at a particular moment in time to help identify their current financial level.

Debt Reduction (The Pathway$ Debt Reduction Plan)

Your proven path to debt freedom starts here! The goal of the DRP is to help you strategically plan and execute your debt reduction through either Snow Ball, Avalanche, or customize order reduction strategy methods.

Middle Class Trap!

The Middle Class Trap is when people buy their WANTS and end up begging for their NEEDS. Pathway$ is a program engineered to encourage financial behavior correction. Learn how to plan your financial spending using “Real Numbers.”

Simple Interest Calculate your simple interest Here!

Simple Interest is money you can earn by initially investing some money (the principal). A percentage (the interest) of the principal is added to the principal, making your initial investment grow!

Based on:

1 Initial Investment Amount

2 Rate of Interest

3 Frequency of interest calculated

4 Duration of loan/investment

1 Initial Investment Amount

2 Rate of Interest

3 Frequency of interest calculated

4 Duration of loan/investment

Compound Interest Calculate your compounded interest Here!

Compound Interest is interest added to the principal of a deposit or loan so that the added interest also earns interest from then on. This additional interest to the principal is called compounding.

Based on:

1 Initial Investment Amount

2 Rate of Interest

3 Frequency of Compounding

4 Duration of loan/investment (in Years)

1 Initial Investment Amount

2 Rate of Interest

3 Frequency of Compounding

4 Duration of loan/investment (in Years)

Retirement Estimate what you'll need to retire Here!

Retirement Calculator is a simple calculator that generates a projected retirement amount based on the money you want to retire with. Calculation is based on either current amount or estimated contribution.

Based on:

1 Initial Investment Amount

2 Age at Retirement

3 Interest

4 Desired Retirement Amount

1 Initial Investment Amount

2 Age at Retirement

3 Interest

4 Desired Retirement Amount

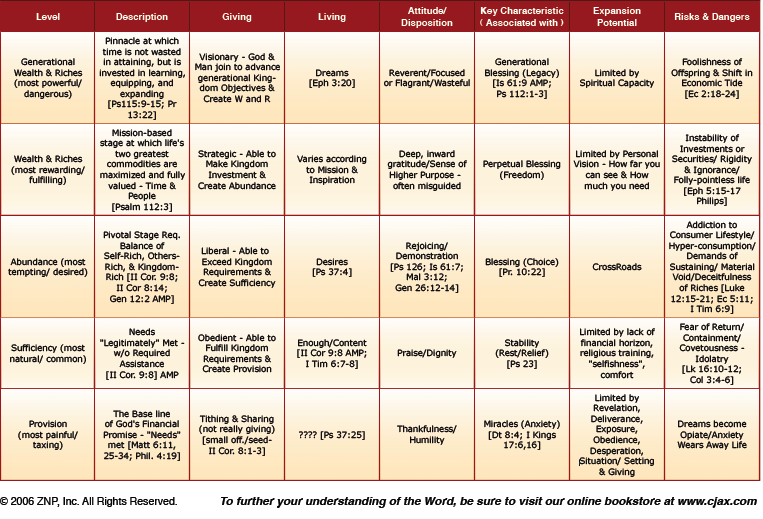

Kingdom Financial Matrix

Avalanche

(Highest Interest First)

This strategy results in the lowest total interest, but depending on the balance of your higher interest loans, it may take you longer to see your first loan/debt completely paid off. If the difference in the total interest is not significant, then you may get more satisfaction from the 'Snow Ball' method.

Snow Ball

(Lowest Balance First)

This strategy gives you the benefit of the 'snowball effect', but you may pay more interest in the end versus the 'Avalanche' method. The main benefit of this approach is the psychological effect of seeing the number of debts disappear more quickly!

Principal Amount:

Time Period in Years: 6 Years

Interest From Period: I = P×r×t where I = amount of interest, P = principal amount, r = annual interest rate, t = time in years

I = × × then rounded to 2 decimal places =

Total After Period: Principal Amount () + Interest in Period () =